Massey Business School staff

Contact details +6469517073

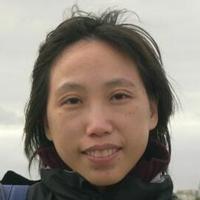

Associate Professor Candie Chang

Associate Professor

School of Accountancy, Economics and FinanceCandie is currently an Associate Professor at the School of Economics and Finance at Massey University. She has a PhD in Finance from the Hong Kong University of Science and Technology. She has broad research interests. Her research topics cover learning and diversity, the importance of top managers to firms, housing markets, behavioural biases in estimation, the survival of firms, investor sentiment, and stock liquidity. Her recent work includes studies examining drivers and impact of cross-border flows. Her outputs have received prizes for outstanding academic research and originality. She also serves as ad hoc reviewer for international academic journals.

Research Expertise

Research Interests

learning, cross-border flows, environmental-related issues, housing markets, analyst forecasts

Area of Expertise

Field of research codes

Applied Economics (140200):

Banking, Finance and Investment (150200):

Commerce, Management, Tourism And Services (150000):

Economics (140000):

Finance (150201):

Financial Economics (140207):

Financial Institutions (incl. Banking) (150203)

Research Outputs

Journal

[Journal article]Authored by: Chang, Y.

[Journal article]Authored by: Chang, Y.

[Journal article]Authored by: Chang, Y., Hao, W.

[Journal article]Authored by: Anderson, H., Chang, Y.

[Journal article]Authored by: Chang, Y., Hsu, W.

[Journal article]Authored by: Chang, Y., Young, M.

[Journal article]Authored by: Chang, Y., Young, M.

[Journal article]Authored by: Chang, Y.

[Journal article]Authored by: Chang, Y.

[Journal article]Authored by: Chang, Y.

[Journal article]Authored by: Chang, Y.

[Journal article]Authored by: Chang, Y.

Book

[Discussion Paper]Authored by: Chang, Y.

[Discussion Paper]Authored by: Chang, Y.

[Discussion Paper]Authored by: Chang, Y.

Teaching and Supervision

Completed Doctoral Supervision

Co-supervisor of:

-

2023

-

Suxiang Zang

-

Doctor of Philosophy

Essays on product market competition

Media and Links

Media

-

22 Mar 2014 - Newspaper

CEO pay-performance relationships

My journal articel titled "CEO ability, pay, and firm performance" (co-authored with Sudipto Dasgupta and Gilles Hilary) was featured in the news article in the Jakarta Post on 22 March 2014. The news

Page authorised by Web Content Manager

Last updated on Tuesday 16 September 2025